Exposure rating with ALAE included with Loss

Hi,

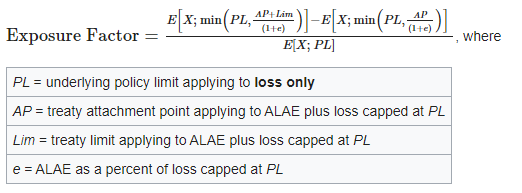

For the Exposure Rating for Casualty per Occurrence Risks, when the ALAE is included with Loss, there is this adjusted exposure factor formula. What is the next step - how do we calculate the reinsurer expected loss and ALAE after calculating the adjusted exposure factor?

If the ALAE is pro-rata to loss, it makes sense that the reinsurer expected loss and ALAE = exposure factor x (expected LR + ALAE%) x subject EP since the exposure factor for ALAE is proportional to the exposure factor for loss, but how do we calculate the "ALAE" portion of the reinsurer expected loss & ALAE when ALAE is included (add on) with loss??

Appreciate your input!

Thanks!

Comments

Hi,

In both cases the reinsurer expected loss and ALAE is determined by: exposure factor * (expected loss and ALAE ratio) * subject earned premium.

Where differences arise is how you calculate the ground-up expected loss and ALAE ratio as it depends on whether ALAE is pro-rata or included as part of loss.

If ALAE is pro-rata with loss then calculate the portion of ground-up losses covered by the treaty and apply this to the ground-up ALAE. Then sum to form the ground-up expected loss and ALAE ratio.

If ALAE is included as part of loss then calculate the ground-up expected loss and ALAE ratio directly through summation.

The exposure factor formula chosen needs to match the ALAE situation, i.e. use the first formula if it's pro-rata and the second (the one you show above) if ALAE is included with loss.

Hope this helps!

Hi,

Thank you for your response but I am not sure if I follow since your description of the treatment of ALAE seems to be for experience rating.

Let's talk about an example:

Given Treaty Limit, Attachment Point, Policy Limit, and

This is what I get:

Could you please demonstrate the approach you described for both pro-rata and included with loss?

As I cannot wrap my head around how to

if we are not given the historical losses in for exposure rating?

Thanks!

Hi,

It's important to remember whose perspective we're rating from and what data is available. We're rating using the reinsurer perspective using data from the primary insurer. So the subject premium is GNEPI (or GNWPI), i.e. the primary insurer premium net of any inuring treaties and the expected loss and expected ALAE ratios (net of inuring) are also from the primary insurer; whether derived from the primary insurer's own experience or are an a priori estimate (for a brand new book say).

Regardless of whether ALAE is pro-rata to loss or part of loss, we calculate the reinsurer's expected loss by applying an exposure factor to the primary insurer's expected loss & ALAE ratio multiplied by the subject premium.

The method of calculating the exposure factor varies according to how ALAE is handled. Essentially, we shift the points under consideration on the exposure curve. If ALAE is pro-rata to loss then we ignore ALAE when calculating the exposure. If ALAE is part of loss then we calculate the primary insurer's ratio of ALAE% to expected loss % and use this to adjust our position downwards on the exposure curve. This reflects that ALAE will take up part of the space within the treaty limits.

Returning to your nicely laid out example, the figures in red should be 70% + 10%.

Does this help clear things up?

Yes! Thanks for clearing my doubts!