W-Clark-PropPerRisk5

Hi,

For the last example for inuring reinsurance "Calculate the Loss Cost with Inuring Reinsurance", the solution calculates the insured value after surplus share as min( surplus share retention, Midpoint). I do not quite understand this, shouldn't the insured value net of surplus share be max(0, midpoint - surplus share retention), then only we apply the excess of loss treaty?

Based on my understanding, the surplus share treaty is bought by the insurer, not the insured, so why would the insured retain the first $200K of each loss (commentary)? Shouldn't the insurer retain the first $200k of each loss and the insured value to calculate exposure factor for reinsurer loss is NET of the portion covered by surplus share?

Please correct me if my understanding is flawed.

Thanks!

Comments

I think this is a case of mixing perspectives as "insured" has different meanings depending on where it is used in the question. In the context of reinsurance, "the insured" means the insurer, not the insurer's policyholders.

We have an insurer, A, who has say a portfolio of high value homes or commercial buildings which they are insuring. Insurer A purchases both a surplus share treaty and an excess of loss treaty. The two treaties needn't be from the same reinsurer. Let's suppose Reinsurer B offers the surplus share treaty and Reinsurer C offers the excess of loss treaty.

Based on the question wording we're told to apply the surplus share treaty first to Insurer A's portfolio.

We are working from the perspective of (Re)insurer C who is trying to price the excess of loss treaty.

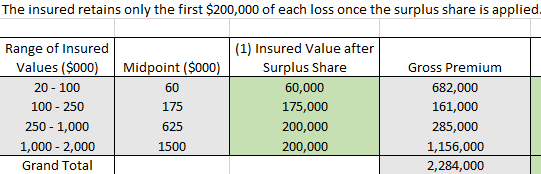

We partition Insurer A's portfolio into a range of values that A is insuring and determine the midpoint of each range.

The surplus share treaty limits Reinsurer B's exposure to an amount which is proportional to the retained line on a per-risk basis. A surplus share treaty usually specifies the number of retained lines and the size of a line rather than just a retention figure. In this case, you're left in the dark as to how the surplus share treaty works so you're forced to assume that applying the surplus share treaty results in Insurer A retaining up to $200,000 per risk.

Insurer A is then further limiting their exposure to any single risk by ceding losses in the range $100,000 to $200,000 per-risk.

The "insured value after surplus share" is then the amount retained by Insurer A after the surplus share treaty has been applied. This is then used by Reinsurer C to price the excess of loss treaty.

Thanks for the clear explanation!