tracyguo8

Comments

-

Hi! Could you please explain why we choose 10M instead of 0M?

-

Using the same coefficient as yours, and further suppose coefficient for BodyType:Van is -0.1.

Based on the interaction term, we can agree non-small engine size is the base class for engine size and non-van is the base class for body type.<…

-

Sorry I read the "Interacting a Categorical Variable with a Continuous Variable" section but I don't think it mentioned power law - do you mind pointing me to the section that describes this?

Paragraph (2) and (4) sound contradictory to me …

-

right exactly, so isn't the battlecard "Which variable and category is the associated coefficient relative to?" referring to the interaction term coefficient only, which is exactly what you described as "discounts relative between risks that all …

-

I understand that the discount calculated from the coefficient is relative to the risks with small engine size and base body type, but isn't it the coefficients estimate from the GLM output itself describes the magnitude of discount which is rela…

-

makes sense, thanks!

-

so do you mean that employers will ALWAYS tend to report more when the weight on certain type of claim is reduced regardless of the severity (med-only or non-med claims), and vice versa?

I am just simply wondering if the question asks the i…

-

Will the size of the med-only losses (which are small) make a difference?

if the weight on med-only loss is increased, will the employers also report more because reporting more smaller losses can lower the mod?

-

Thank you for the graph and the detailed explanation!

-

Do you mind creating a graph? it is not too clear describing them in words.

- why would the two curves meet at the common point (F(1),1) if they have the same distribution?

- Isn't it curve A already lies above B if A is steeper e…

-

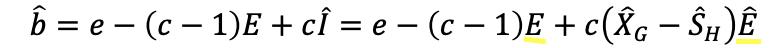

wondering why we cannot directly calculate rG and rH since we have min and max premium, and E? (i.e. rG = max prem / E and rH = min prem / E)

Thank you for the fix!

The paragraph was explicitly discussing about when there is per occurrence limit L, so without adding context of the total expected loss = total payment made by insurer when there is no limit or deductible under that explanation, adds some confus…

Hi,

To follow up on this, BattleWiki states "The implied maximum ratable loss increases the basic premium by adding a charge for expected losses above the maximum ratable loss amount. This reduces the implied maximum ratable loss and thus i…

thanks so much! this clarifies!

Hi,

I would like to follow on this. I took a look at the example 5.10 in the source text, and I also get your point that there are claim severities which even after applying inflation are still below excess AP.

I tried to determine th…

Thanks for the clear explanation!

Thanks, in the scenario where all claims exceed attachment point after inflation, will the claim size inflation in excess layer = ground up inflation?

Thanks for explaining!

Thanks for explaining - follow up questions:

- On your 2nd paragraph, "Therefore we can always express one of the categories as a linear combination of the others. However, this is provided we have an intercept." Do you mean in this que…

Hi,

A few questions on 2015 Fall 2c:

- the examiner report for Part states "To address the intrinsic aliasing, the candidate needed to remove one additional parameter or remove two parameters (one territory and one vehicle type) an…

I see! I am able to see the full questions on Full BattleQuiz. I was going from the Quiz Scores page to the respective full list of questions but the Qz-10 questions are not in there. Could you please make sure this is fixed as well?

Thanks…

Hi,

The Qz-10 questions seem to disappear. Would you please bring it back?

Thanks!

Thanks for the clarification!!

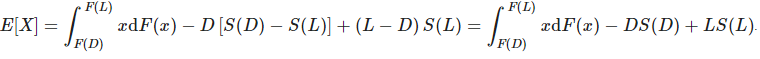

On your second point, if we use the Table M version of basic premium formula, it would be the following which uses I, that is calculated using E(A).

Thank you! I have a follow-up question.

In the Fisher.Visualization, there are a few formulas for basic premium. For limited table M, the formula is

Got it thanks! Is there any other loss sensitive plans that are excess insurance other than SIR?

Thanks for the explanation!