Fisher.TableL: Difference between revisions

No edit summary |

|||

| Line 15: | Line 15: | ||

* fact A... | * fact A... | ||

* fact B... | * fact B... | ||

{|class="wikitable" | |||

|- | |||

| Questions are held out from most recent exam. (Use these to have a fresh exam to practice on later. For links to these questions see [[Exam Summaries]].) | |||

|} | |||

: {| class='wikitable' style='width: 1000px;' | : {| class='wikitable' style='width: 1000px;' | ||

Revision as of 17:36, 10 July 2020

Reading: Fisher, G. et al, "Individual Risk Study Note," CAS Study Note, Version 3, October 2019. Chapter 3. Section 5

Synopsis: To follow...

Study Tips

...your insights... To follow...

Estimated study time: 3 hours (not including subsequent review time)

BattleTable

Based on past exams, the main things you need to know (in rough order of importance) are:

- fact A...

- fact B...

| Questions are held out from most recent exam. (Use these to have a fresh exam to practice on later. For links to these questions see Exam Summaries.) |

reference part (a) part (b) part (c) part (d) Currently no exam questions for this reading

In Plain English!

A (California) Table L is used to estimate the per-occurrence charge and aggregate excess charge together in a single table. The entries in a Table L are organized by policy size, entry ratio and per-occurrence limit (deductible). The Table L entry ratio is defined as [math]r=\frac{\mbox{actual }{\color{red}\textbf{limited}}\mbox{ aggregate losses}}{\mbox{expected }{\color{red}\textbf{unlimited}} \mbox{ aggregate losses}}[/math]. Note that in the entry ratio for a Limited Table M both the numerator and denominator were limited.

The Table L insurance charge at entry ratio r is denoted by [math]\phi_D^\star (r)[/math] and is the average difference between a risk's actual unlimited loss and its actual loss limited to D plus the limited loss greater than [math]r\cdot E[/math]. Here E is the unlimited expected loss. The superscript * and subscript D tells us the entry ratio is for a Table L with per-occurrence limit D.

The Table L insurance savings, [math]\psi^\star_D(r)[/math], is the average amount by which the risk's actual limited loss is less than [math]r\cdot E[/math]. The Table L insurance charge and insurance savings are a ratio to expected unlimited loss. This means the loss cost is given by [math]\phi^\star_D(r)\cdot E[/math].

Recall Y is the distribution of unlimited losses and its cumulative distribution is F(y). Then FD(y) is the cumulative distribution of Y restricted by the per-occurrence limit, i.e. the cumulative distribution of the primary layer of losses. Then [math]\phi_D^\star (r) =\displaystyle\int_r^\infty (y-r)\mathrm{d}F_D(y)+k[/math], where [math]k=\frac{E-E[A_D]}{E}[/math] is the excess ratio for the per-occurrence limit. The Table L insurance savings is [math]\psi_D^\star(r)= \int_0^r(r-y)\mathrm{d}F_D(y)[/math]. These formulas avoid double counting losses because they use the limited cumulative distribution FD(y) and the excess ratio, k.

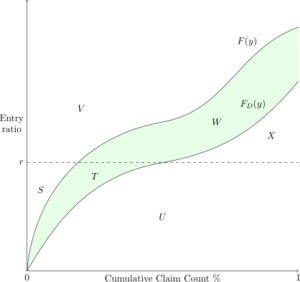

It can be helpful to view a Lee diagram of the situation when there is both a per-occurrence limit and an aggregate limit (see Figure 1 below).

The region T + W represents the per-occurrence excess losses, so [math]T+W=k[/math]. The area U + X is the primary loss distribution, i.e. losses used to price the aggregate excess limit. Region X is the aggregate loss distribution in excess of the aggregate limit. Summing gives the insurance charge for the policy as [math]\phi_D^\star(r)=X+T+W[/math]. The Table L insurance savings, [math]\psi_D^\star(r)[/math], is the region S + T. These regions should be compared to the case when there is only an aggregate limit, in which case [math]\phi(r)=W+X[/math] and [math]\psi(r)=S[/math]. Lastly, the relationship between the insurance savings and insurance charge still holds true for a Table L, namely [math]\psi_D^\star(r)=\phi_D^\star(r)+r-1[/math].

|

Can you prove [math]\psi_D^\star(r)=\phi_D^\star(r)+r-1[/math] using the Lee diagram? |

How to Build a Table L Using Empirical Data

To build a Table L using empirical data you need both the unlimited losses and losses limited by the per-occurrence limit for a group of risks which have similar size and the same per-occurrence limit. Here's the procedure:

- Compute the excess ratio [math]k=\frac{E-E[A_D]}{E}[/math]. This is fixed for all risks in the group.

- Compute the entry ratio for each risk in the group of risks. The entry ratio is the ratio of actual limited losses to expected unlimited losses.

- If necessary, re-order the risks in the group so the entry ratios are in increasing order.

- Apply the horizontal slicing method to calculate [math]\phi_D^\star(r)-k[/math].

- Add the excess ratio on to price the total loss cost for the entry ratio.

- Use [math]\psi_D^\star(r)=\phi_D^\star(r)+r-1[/math] to compute the insurance savings to complete the table.

To see this in action, here's the example used in the text.

If we have claim level unlimited losses (as opposed to risk/policy level losses) then we can calculate a Table L for any desired per-occurrence limit (deductible).

Using Simulated Data to Build a Table L

To simulate data for a Table L you need to separately do two things:

- Simulate the number of claims,

- Simulate the severity of each claim.

This allows you to correctly apply the per-occurrence limit. It is not enough to know the parameterized form of the unlimited aggregate loss distribution and the excess ratio.

The Insurance Charge Reflecting Loss Limitation (ICRLL) Method

Although computing power and data storage is readily available today, historically Table M and Limited Table M were printed. Rather than producing multiple Limited Table M's for various per-occurrence limits (deductibles) it is (was) often easier to use a process to modify Table M to approximate the Limited Table M for a given per-occurrence limit (deductible).

The Fisher text demonstrates an example of this using the 1998 NCCI Table M which is arranged by Expected Loss Group (ELG) instead of expected number of claims. Adjustments are made by state and hazard group to account for differences in severity between risks within an expected loss group.

Recall a Limited Table M is defined by three characteristics: expected limited loss, entry ratio, and deductible; whereas Table M is defined by two characteristics: expected unlimited loss and entry ratio. The ICRLL method may be viewed as mapping the Limited Table M onto Table M. To do so, modifications are required to the Limited Table M entry ratio and expected loss group. Here's how to apply the ICRLL method:

- Compute the entry ratio which is the actual limited aggregate loss divided by the expected limited aggregate loss. (Remember: we're working with a Limited Table M.

- Compute the excess ratio [math]k=\frac{E-E[A_D]}{E}[/math].

- Compute the ICRLL adjustment, [math]\mathrm{ICRLL}=\frac{1+0.8\cdot k}{1-k}[/math].

- Compute the Adjusted Expected Loss = (Expected unlimited aggregate loss) * (state/hazard group adjustment) * (ICRLL).

- Find the expected loss group that contains the adjusted expected loss.

- Find the insurance charge in Table M by looking up the value determined by the entry ratio and expected loss group.

- Calculate the aggregate limit charge using [math]\phi(r)\cdot E[A_D][/math].

- Calculate the per-occurrence limit charge using [math]E-E[A_D][/math].

- Calculate the total loss cost of the policy by summing the per-occurrence and aggregate charges.

| Key Point: Since we're pricing a policy we don't know the actual limited loss (yet); replace it with the aggregate policy limit in the entry ratio calculation. |

To see this in action, here's the example used in the text.

Pop Quiz Answers

To prove the relationship it is helpful to observe the area under F(y) equals 1 so [math]T+W+U+X=1[/math]. Similarly, the entry ratio r creates a rectangle of area r so [math]r=S+T+U[/math]. Then [math]\begin{align}\phi_D^\star(r) +r-1 &= (X+T+W) +(S+T+U) - (T+W+X+U) \\ &= S+T \\ &= \psi_D^\star(r)\end{align}[/math].