Fisher.Visualization

Reading: Fisher, G. et al, "Individual Risk Study Note," CAS Study Note, Version 3, October 2019. Chapter 3. Section 2

Synopsis: To follow...

Study Tips

...your insights... To follow...

Estimated study time: x mins, or y hrs, or n1-n2 days, or 1 week,... (not including subsequent review time)

BattleTable

Based on past exams, the main things you need to know (in rough order of importance) are:

- fact A...

- fact B...

reference part (a) part (b) part (c) part (d) no prior questions

In Plain English!

When working with per-occurrence limits and aggregate limits it can be helpful to visualize them. A widely used approach to visualizing them was developed in a paper by Yoong-Sin Lee [1].

Alice: "Lee's paper isn't on the syllabus itself, but sometimes with tricky material it helps to refer to the original source."

The graphs described in the paper are usually referred to as "Lee diagrams". A Lee Diagram has the cumulative claims (count or percentage of loss distribution) on the horizontal axis, and the severity or aggregate loss (the "size") on the vertical axis. Let's look at this in more detail.

Let n be the number of losses, let the loss sizes be x1, ..., xq and assume they're ordered such that x1 < x2 < ... < xq. Let the associated loss frequencies be given by n1, ..., nq thus n = n1 + ... + nq.

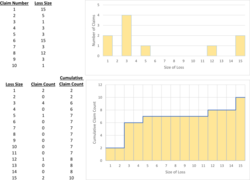

Figure 1 below shows the more traditional way of viewing a sample of 10 claims. Notice how in the second part of the figure we've ordered the claims by loss size and added the incremental and cumulative counts. So here x1 = 1, x2 = 2, ..., x15 = 15 and n1 = 2, n2 = 0, ..., n15 = 2, and n = n1 + ... + n15 = 10.

When we produce a diagram like Figure 1 we are asking ourselves: "For a fixed size of loss, how many claims (count or percentage) are smaller than this loss size?"

To draw a Lee diagram we need to turn this question around and ask: "What is the size of loss that k% of claims are smaller than?"

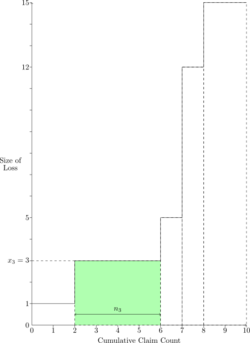

Figure 2 below shows a Lee diagram of the ten claims used in Figure 1 above. To sketch this, order the losses (the xi's) from smallest to largest. Let k be either the cumulative claim count or the percentage of claims, in the latter case the horizontal axis will be scaled between 0 and 1. For each value of k find the value q such that [math]\displaystyle\sum_{i=1}^{q-1} n_i \leq k \lt \displaystyle\sum_{i=1}^q n_i[/math]. Plot the point (k, xq).

For example, there are 10 claims in Figure 1. Letting k = 5 we see that the cumulative claim count column goes directly from 2 to 6, which means q = 3. This means we plot the point (5, x3) = (5, 3) on the Lee diagram. Since we're dealing with discrete data we get a step function, with the next value being (6, 5) as the next claim size is 5 and when we reach that we've incurred six claims.

Notice in Figure 2 above that the green shaded area is a rectangle of height 3 and width 4. This corresponds to the incremental number of claims for claim size three. So an easier way of remembering to draw a Lee diagram is to order the claims by size and then draw successive rectangles whose height is the claim size and width is the number of claims of that size. Lastly, observe the area of the green shaded rectangle is the same as the total cost of all claims of size 3.

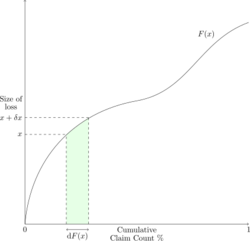

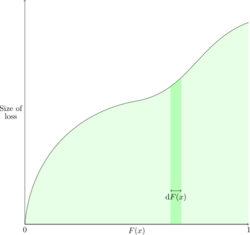

Figure 3 below generalizes this idea to the continuous case where a small change in cumulative probability, dF(x), corresponds to losses of size between x and x + δx. Then the vertical strip represents x''dF(x) which is the expected loss of the strip. Summing these infinitely small strips gives the expected value [math]E[X]=\displaystyle\int_0^\infty x\mathrm{d}F(x)[/math]. Observe F(x) goes from 0 to 1 but dF(x) goes from 0 to [math]\infty[/math] because to change F(x) we must move the underlying loss between 0 and positive infinity.

Applying a per-occurrence limit L

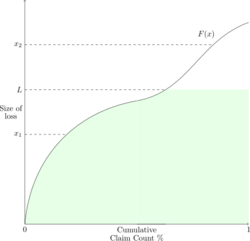

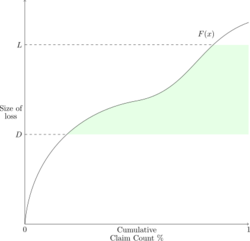

Figure 4 below is a Lee diagram when there is a per-occurrence limit L on the policy. The shaded area represents the expected payment per loss because the horizontal axis is the cumulative claim count percentage. When the horizontal axis was the cumulative claim count the shaded area represented the total expected loss. Normalizing the horizontal axis to a percentage gives a per loss basis.

Losses of size x1 < L are paid out in full whereas losses that exceed L are paid out at L.

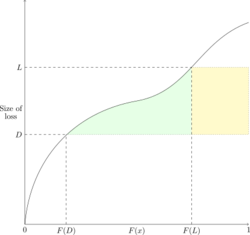

Applying a per-occurrence deductible D and limit L

Figure 5 below shows a Lee diagram when there is both a per-occurrence deductible D and a per-occurrence limit L on the policy. The payout per claim is best expressed as follows

[math]\mbox{payout} = \begin{cases} x \lt D & 0 \mbox{ (No payout)} \\ D \lt x \lt L & x-D\\ L \lt x & L-D \end{cases} [/math]

The shaded area is the expected payout per loss under both the deductible and limit.

Calculating with Lee Diagrams

You can calculate the area of the shaded region in a Lee diagram using integration along either of the axes. Alice: "Remember, just like in Calc III, one way may be easier than the other."

First, let's consider the size method which is where we integrate along the horizontal axis by adding up lots of infinitely small vertical strips to form the shaded area (see Figure 6 below). Each strip has width δF(x) and height x. This gives [math]E[X]=\displaystyle\int_0^\infty x\mathrm{d}F(x)[/math]. Again, remember for F(x) to go between 0 and 1, the size of loss, x, must range between 0 and positive infinity.

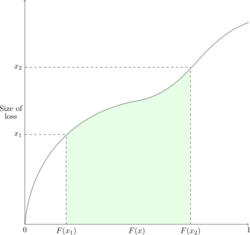

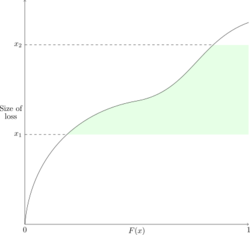

Figure 7 below explains why this is known as the size method. Given F(x1) and F(x2) we're only considering the expected value of claims between x1 and x2 in size, that is, not all claims are considered.

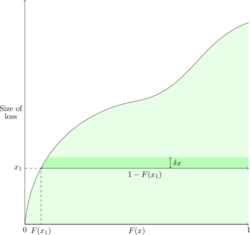

Now let's consider the layer method which is where we integrate along the vertical axis by summing up infinitely small horizontal bands to form the shaded area (see Figure 8 below). Each band has height δx and width [math]1-F(x)=S(x)[/math] where S(x) is the survival function for F(x). This yields the expected loss per claim (the shaded area) as [math]E[X]=\displaystyle\int_0^\infty 1-F(x)\mathrm{d}x = \int_0^\infty S(x)\mathrm{d}x[/math].

Figure 9 below shows why this is called the layer method because given a layer of claims [x1, x2] it considers all claims but only computes the expected loss contributed between x1 and x2, i.e. only considers the part of the loss within the layer.

Returning to the idea of a policy with a per-occurrence deductible D and per-occurrence limit L we observe the layer method gives [math]E[X]=\displaystyle\int_D^L S(x)\mathrm{d}x[/math] relatively easily (see Figure 10). Yet to calculate this using the size method we have to compute and add together the green and yellow shaded areas in Figure 10. This area may be expressed using the survival function as [math]E[X]=\displaystyle\int_{F(D)}^{F(L)}x\mathrm{d}F(x) - d\left[S(D)-S(L)\right]+\left(L-D\right)S(L) = \displaystyle\int_{F(D)}^{F(L)}x\mathrm{d}F(x) -DS(D)+LS(L)[/math]. You arrive at the same result if you think in terms of F rather than S but the algebra is a little more involved.

Aggregate Policy Provisions

So far we've visualized the severity distribution of a single claim subject to a per-occurrence limit and a deductible. Now we'll consider the impact of applying aggregate policy provisions. Our goal now is to understand and estimate aggregate excess losses. We'll do this first by assuming there is an aggregate limit and no per-occurrence limit.

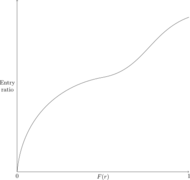

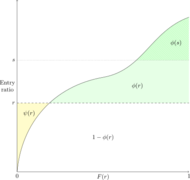

We may think of the aggregate loss distribution as the result of many simulations of a loss on a single policy. Previously, we calculated and visualized the expected loss for a single claim. Thus, since we know the result of the simulation (the actual loss), we can form an entry ratio [math]r=\frac{\mbox{actual loss}}{\mbox{expected loss}}[/math] for each simulation (see Fisher.AggExcess). We then proceed as before by ordering the entry ratios from smallest to largest and plotting the distribution. The horizontal axis remains the cumulative claim count (cumulative entry ratio) percentage, while the entry ratio is plotted on the vertical axis (see Figure 11).

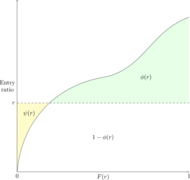

For a given entry ratio, r, we can draw the insurance change and insurance savings on the Lee diagram (see Figure 12). Recall from Fisher.AggExcess, the insurance charge is [math]\phi(r)=\displaystyle\int_r^\infty \left(y-r\right)f(r)\mathrm{d}r[/math] and this corresponds to the green shaded region. Similarly, the yellow shaded region is [math]\psi(r)=\displaystyle\int_0^r\left(r-y\right)\mathrm{d}F(y)[/math], where F is the cumulative aggregate loss distribution.

Key Points

- The area under the cumulative aggregate loss distribution is 1.

- φ(r) decreases as r increases, i.e. [math]\phi(r)\rightarrow 0 \mbox{ as } r\rightarrow \infty[/math]

- ψ(r) is an increasing function of r, i.e. [math]\psi(r) \rightarrow 0 \mbox{ as } r\rightarrow 0 \mbox{ and } \psi(r)\rightarrow\infty \mbox{ as } r\rightarrow\infty[/math].

- [math]\phi^\prime(r) = -S(r), \phi^{\prime\prime}(r)=f(r)[/math]

- [math]\psi^\prime(r) = F(r), \psi^{\prime\prime}(r)=f(r)[/math]

- Key Formula: [math]\color{red}\psi(r)=\phi(r)+r-1[/math].

These points are illustrated in Figures 12 and 13 above. Points 4 and 5 are derived by analyzing small horizontal strips.

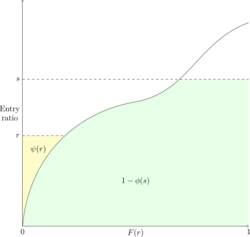

Minimum and Maximum Ratable Loss

In experience rating it's common to find a minimum and/or maximum ratable loss; these are used to stabilize premiums from being extremely low or high. We can express the minimum and maximum ratable losses in terms of the entry ratio multiplied by the expected loss E; the minimum ratable loss is rE and the maximum ratable loss is sE for some r < s. Then letting A be the actual aggregate loss gives the aggregate ratable loss as [math]L = \begin{cases} sE & \mbox{if }A \gt sE\\ A & \mbox{if }rE \lt A \lt sE\\ rE & \mbox{if } A \lt rE. \end{cases} [/math]

On our Lee diagram this looks like the green and yellow shaded area in Figure 14 which is the ratio of the expected aggregate loss to expected loss. The actual aggregate losses with entry ratios above s are capped at sE while actual aggregate losses with entry ratios below r are brought up to rE. Thus, [math]\left[1-\phi(s)\right]\cdot E[/math] represents applying the maximum ratable loss and [math]\psi(r)\cdot E[/math] is the additional cost from the minimum ratable loss. This yields the following important formula [math]\color{red}\mathbf{\frac{L}{E}=1+\psi(r)-\phi(s)}[/math]. Here L is the aggregate ratable loss and E is the expected loss.

Lee Diagrams and Retrospective Rating

In Fisher.RiskSharing we learned [math]R=\left(B+cL\right)\cdot T[/math] where T is the tax multiplier, which we'll drop for now, c is the loss conversion factor, L is the ratable loss, and B is the base premium. By taking the expectation of each side we get [math]E[R]=B+cE[L][/math]. Our goal is to derive a convenient formula for B.

The base premium is defined as B = bP where P is the standard premium (see Fisher.ExpRating) and b is the basic premium ratio.

Using the Lee diagram in Figure 14 above, we have [math]\begin{align}E[L]&=E+E\cdot\psi(r)-E\cdot\phi(s)\\ &= E-E\cdot\left(\phi(s)-\psi(r)\right) \\&= E-I\end{align}[/math], where r is the entry ratio for the minimum ratable loss and s is the entry ratio for the maximum ratable loss. I is known as the net insurance charge.

Also, a retrospective rating plan should cover the expenses, e, and expected loss, E, associated with the plan. Letting R denote the premium for the plan means we want E[R] = e + E.

By equating the two expressions for E[R] above we get [math]B+cE[L]=e+E[/math], then substituting in the net insurance charge for E[L] and rearranging yields the following key equation [math]\color{red}B=e-(c-1)E+cI[/math].

We can go further and derive two key formulas which relate the entry ratios to the defining plan parameters which are the minimum premium H and the maximum premium G.

- [math]\color{red}\phi(r_H)-\phi(r_G)=\frac{e+E-H}{cE}[/math]

- [math]\color{red}r_G-r_H = \frac{G-H}{cE}[/math]

These formulas are known as the balance equations for aggregate loss.

Click here to see the derivation of the balance equations. Insert Fisher.BalEqDeriv PDF