Bahnemann.Chapter5: Difference between revisions

mNo edit summary |

|||

| Line 155: | Line 155: | ||

The following example from the text shows you how to estimate the asymptotic behaviour, and in the case when a Pareto distribution is appropriate, how to estimate the Pareto parameters. | The following example from the text shows you how to estimate the asymptotic behaviour, and in the case when a Pareto distribution is appropriate, how to estimate the Pareto parameters. | ||

: [https://www.battleacts8.ca/8/pdf/ | : [https://www.battleacts8.ca/8/pdf/Bahnemann_Ex5-4.pdf <span style="color: white; font-size: 12px; background-color: green; border: solid; border-width: 2px; border-radius: 10px; border-color: green; padding: 1px 3px 1px 3px; margin: 0px;">'''''Bahnemann Example 5.4'''''</span>] | ||

===Layer of Coverage=== | ===Layer of Coverage=== | ||

Revision as of 11:32, 28 July 2020

Reading: Bahnemann, D., "Distributions for Actuaries", CAS Monograph #2, Chapter 5.

Synopsis: We gain an understanding of what an excess claim is and how adding upper and lower limits to a policy can affect the claim count, severity and aggregate distributions. We also look at the impact of trends/inflation and briefly consider claim contagion.

Study Tips

Although the material in this section isn't too tricky, you do need to be good/careful with your algebra. Most of the time the CAS will likely work this material into bigger questions on other topics such as reinsurance. As such, your first read should be to understand Bahnemann and then later you should come back and re-read it once you've covered more of the syllabus readings.

This material is formula heavy. We've omitted some of the more dense formulas from the chapter to help you focus on what we believe you'll need to memorize. Typically, the CAS gives complicated formulas in the exam. That said, you should skim the source for the more complicated formulas so you can recognize them if needed.

Estimated study time: 3 days, (not including subsequent review time)

BattleTable

Based on past exams, the main things you need to know (in rough order of importance) are:

- How to calculate expected losses and claim counts for a layer/excess layer.

- Describe and calculate the impacts of trending and inflation on excess layer losses and counts.

- Be able to work with basic and advanced probability distributions, particularly if given key formulas.

- Calculate excess severity.

| Questions are held out from most recent exam. (Use these to have a fresh exam to practice on later. For links to these questions see Exam Summaries.) |

reference part (a) part (b) part (c) part (d) E (2018.Fall #1) Chi-squared test and MSE

- Mahler.CredibilityReinsurance Profit

- Clark.ReinsuranceCoefficient of Variation

- calculateLognormal probabilities

- calculate & applyE (2018.Fall #2) Guaranteed Cost Premium

- calculateDeductibles & Premiums

- Bahnemann.Chapter6Deductibles & Credit risk

- Bahnemann.Chapter6Risk loaded ILFs

- Bahnemann.Chapter6E (2018.Fall #13) Expected Excess Claims

- calculateClaim Count Inflation

- calculateE (2017.Fall #8) Layer Claim Frequency

- calculateLayer Pure Premium

- calculateE (2017.Fall #14) Excess Severity Graph

- drawReinsurer Expected Loss

- calculateE (2014.Fall #6) Claim Layer Trending

- drawClaim Layer Trending

- calculate trendE (2014.Fall #25) Exposure Curve

- Bernegger.ExposureGround-up Loss

- calculate from treatyE (2012.Fall #12) Excess Ratio

- undeveloped lossesExcess Ratio

- developed lossesExcess Ratio

- infer distributional impactE (2012.Fall #15) Excess losses

- layer with inflationExcess losses

- critique method

Full BattleQuiz You must be logged in or this will not work.

In Plain English!

Chapters 1 through 4 aren't on the exam but are worth quickly reading if you have time. You don't need to worry about the proofs but it is a great introduction to the distributions you'll be using in chapters 5 and 6.

Overview of Excess Claims

All claims are restricted in size to at least as large as some fixed amount A > 0. We do not know anything directly about claims smaller than A as these would be paid at $0, so not reported to the insurer in general. A common example of this is a deductible, but other situations can occur such as when an insurer covers a non-primary layer of claims in the case of umbrella insurance.

Mathematically, if X is an unlimited claim size random variable, we define the random variable Y by [math]Y=\begin{cases}0 &\mbox{if }0\leq X\leq A \\ X-A & \mbox{if }A\lt X\lt \infty\end{cases}[/math].

The distribution Y reflects the claim size modified by the condition that the insurer pays nothing until claims reach a certain size, A.

The cumulative distribution function for Y is [math]F_Y(y)=Pr(Y\leq y)=\begin{cases}0 & \mbox{if } -\infty \lt y\lt 0 \\ F_X(y+A) & \mbox{if } 0\leq y\lt \infty\end{cases}[/math].

If [math]E[X][/math] exists then [math]E[Y][/math] does as well. We have [math]E[Y]=E[X]-E[X;A][/math], where [math]E[X;A][/math] is the expected value of X limited to A. Since this is a positive amount, we have [math]E[Y]\leq E[X][/math].

Since insurers are mainly interested in claims which they have to pay out on, it's better to work with the variable, [math]X_A=X-A[/math], which is defined on [math]A\lt X\lt \infty[/math] and is called the excess of X over the limit A. This variable ignores claims less than or equal to A and reduces all others by amount A. When a variable X is modified in this fashion, it is said to be truncated from below and shifted by A.

Three formulas worth memorizing are:

- [math]F_{X_A}(x)=Pr(X-A\leq x \;|\; X\gt A) =\begin{cases}0 & \mbox{if } -\infty\lt x\lt 0 \\ \frac{F_X(X+A)-F_X(A)}{1-F_X(A)} & \mbox{if }0\leq x\lt \infty\end{cases}[/math]

- [math]E[X_A]=\frac{E[X]-E[X;A]}{1-F_X(A)}[/math]

- [math]E[X_A;L]=\frac{E[X;A+L]-E[X;A]}{1-F_X(A)}[/math] for some limit [math]L\geq A[/math].

Bahnemann gives formulas for [math]E[X_A^2][/math] and [math]E[X_A^3][/math]. Since they're fairly complicated, it's likely you would be given them in the exam if needed.

Since Pareto distributions are common in insurance applications, it's worth taking a look at Example 5.2 from the text.

Question: Calculate [math]E[X_d][/math] for a Pareto claim size variable X.

- Solution:

- The probability density function of a Pareto distribution is [math]f_X(x)=\frac{\alpha\beta^\alpha}{(x+\beta)^{\alpha+1}}[/math], [math]0\lt x\lt \infty[/math]. The expected value, [math]E[X][/math] of a Pareto distribution is [math]E[x]=\frac{\beta}{\alpha-1}[/math] and is defined whenever [math]\alpha\gt 1[/math].

- Rather than calculating directly, let's make an observation. We have [math]f_{X_d}(x) = \frac{f_X(x+d)}{1-F_X(d)}=\frac{\alpha(d+\beta)^\alpha}{(x+d+\beta)^{\alpha+1}}[/math]. This is itself a Pareto distribution with parameters α, [math](d+\beta)[/math]. Consequently, we immediately get [math]E[X_d]=\frac{d+\beta}{\alpha-1}[/math].

- Keeping an eye out for relations like this can save you a lot of time on the exam...

Excess Severity

The quantity [math]E[X_A][/math] is called the mean excess claim size at A or excess severity or sometimes mean residual life at A.

The excess severity varies with the limit A. By treating the excess severity as a function of the limit, we can see how different distributions behave. We have [math]E[X_x]=e_X(x)=\frac{E[X]-E[X;x]}{1-F_X(x)}[/math] for [math]0\lt x\lt \infty[/math]. Note [math]e_X(x)[/math] is just a common form of alternate notation for the excess severity distribution.

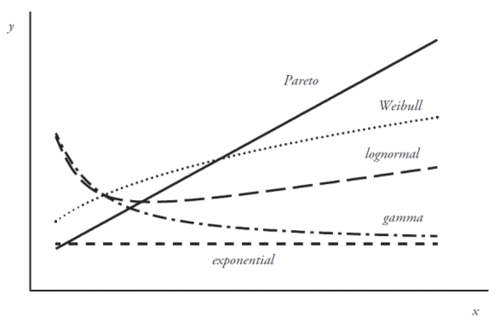

Figure 5.1 from the text is reproduced below. It shows the excess severity behaviour for different distributions. You should be able to look at the graph of an excess severity distribution and identify the underlying distribution.

Bahnemann notes the asymptotic behaviour of the excess severity distribution (i.e. what happens for "large" x values) is one of the easiest ways to tell the underlying distributions apart. However, he cautions this approach is limited by the availability of data, you must make sure there are enough "large" claims to be able to estimate the asymptotic behaviour.

Key Observations from Figure 5.1

|

The following example from the text shows you how to estimate the asymptotic behaviour, and in the case when a Pareto distribution is appropriate, how to estimate the Pareto parameters.

Layer of Coverage

An insurance policy can have both a lower and an upper limit on the claims covered. The lower limit is often a deductible or the limit of underlying coverage in the case of an excess liability or umbrella policy. The upper limit is the policy limit, which is the maximum payout for a claim.

For an excess variable XA which is subject to an upper limit L, the amount paid by the insurer for a claim is the unrestricted amount x, first decreased by the amount A and then capped by the quantity L. This assumes the initial claim size exceeded A. We say these claims are in the layer of coverage defined by A and L.

The quantity A is known as the underlying limit or attachment point. The quantity L is known as the layer limit or width of the layer. A claim, x, which satisfies x > A is said to penetrate the layer.

If A > 0 then we have an excess layer. Policies which only have an upper limit have claims are said to be first-dollar or ground-up.

| Key Formulas to Memorize for Working with Layers

Let [math]X_{A,L}[/math] be the claim size random variable for the layer [math](A,A+L][/math]. Then

|

While the last formula looks hard to memorize, notice the symmetry between the squared terms and the terms inside (). It's important to memorise this formula because it allows you to calculate the variance of the layer.

By placing limits on the claim size, we reduce the variance of the claims. The smaller the layer, the less variation in the size of claims within the layer.

One way of comparing different distributions for claim size is to look at the coefficient of variation. [math]CV[X]=\frac{\sqrt{Var(X)}}{E[X]}[/math]. Since this is a dimension-less quantity, it can readily be used to compare between different distributions.

mini BattleQuiz 1 You must be logged in or this will not work.

Excess Claim Counts

Let NA be the random variable which counts excess claims, i.e. the number of claims which exceed A in size. The distribution of excess claim counts depends on both the underlying claim count distribution and the unlimited claim size distribution X.

Given an unlimited claim size distribution X, the probability of a claim exceeding the limit A is [math]p=1-F_X(A)[/math]. The probability distribution for the excess claim count is given by: [math]f_{N_A}(n)=\displaystyle\sum_{k=n}^\infty\textrm{Pr}\left(n \mbox{ excess claims }|\; N=k\right)\cdot\textrm{Pr}\left(N=k\right)= \sum_{k=n}^\infty\binom{k}{n}p^n(1-p)^{k-n}f_N(k)[/math].

A couple of useful formulas to memorize are:

where N is the claim count distribution for the unlimited claim size random variable X. |

In particular, remember if N is a Poisson distribution with parameter λ then NA is also Poisson distributed with parameter [math]\lambda_A=p\lambda[/math]. Similarly, if N is a negative binomial distribution with parameters [math](\alpha, \nu)[/math] then NA has a negative binomial distribution with parameters [math](\alpha,p\nu)[/math].

Effects of Inflation

Let r% be the rate of inflation, then the inflationary factor is [math]\tau=1+r[/math]. Applying this inflationary trend to the ground-up claim size limited at A, i.e. the random variable XA gives

- [math] E[\tau X_A]\frac{\tau E[X]-\tau E[X;\frac{A}{\tau}]}{1-F_X\left(\frac{A}{\tau}\right)}[/math].

The impact of inflation of the excess claims is then given by

- [math]\tilde{\tau}=\frac{E[\tau X_A]}{E[X_A]}=\tau\cdot\frac{E[X]-E[X;\frac{A}{\tau}]}{E[X]-E[X;A]}\cdot\frac{1-F_X(A)}{1-F_X\left(\frac{A}{\tau}\right)}[/math].

This is the effective trend factor for the excess claims.

Key Points

|

Now turning our attention to excess claim counts. Logically speaking, a positive rate of inflation should increase the number of excess claims because it's now easier for a claim size to exceed A. Letting [math]E[N][/math] be the expected number of ground-up claims and [math]\tau_X[/math] be the claim size trend factor, we have

- [math](1-F_X(A))E[N][/math] expected excess claims before inflation, and

- [math](1-F_X\left(\frac{A}{\tau_X}\right))E[N][/math] expected excess claims after inflation.

This gives the excess claim count effective trend factor, [math]\tilde{\tau}_N[/math], which is only due to the effect of inflation on the claim size, X, as [math]\tilde{\tau}_N=\frac{1-F_X\left(\frac{A}{\tau_X}\right)}{1-F_X(A)}[/math].

Key point

|

We now combine our results about the effects of inflation on excess claim counts and excess claim severity to look at its impact on aggregate excess claims.

Before inflation, assuming claim size and claim counts are independent, we have [math]E[S]=E[N_A]\cdot E[X_A]=E[N_A]\cdot\left(E[X]-E[X;A]\right)[/math].

After applying an inflationary trend factor, [math]\tau_X[/math], to the unlimited claim size, we get [math]\tilde{\tau}_S=\tau_X\frac{E[X]-E[X;\frac{A}{\tau_X}]}{E[X]-E[X;A]}[/math].

It's straightforward to argue (as Bahnemann does in the text on p.155) that the aggregate effective trend factor is at least as large as the claim size inflation trend for positive inflation. If there is deflation, i.e. [math]\tau_X\lt 1[/math], then the aggregate effective trend factor is smaller than the claim size deflationary trend.

mini BattleQuiz 2 You must be logged in or this will not work.

Claim Contagion & Aggregate Layer Claims

Claim contagion is a topic introduced in Section 3.5 of Bahnemann which isn't a required part of the syllabus. However, it features prominently in the brief discussion of aggregate layer claims in Chapter 5 which is on the syllabus.

Claim contagion reflects the likelihood that a successful claim increases the likelihood of other successful claims in the future. The claim contagion parameter, [math]\gamma[/math], serves to increase the variance of the distribution because each outcome changes the likelihood of future outcomes.

Let S be the aggregate loss random variable for the excess layer [math](A,A+L][/math]. Let N be the claim count distribution with mean [math]E[N]=\lambda[/math] and let [math]\gamma[/math] be the claim contagion parameter, then:

- [math]E[S]=\lambda\left(E[X;A+L]-E[X;A]\right)[/math]

- [math]Var(S)=\lambda\left(E[X^2;A+L]-E[X^2;A]\right)-2AE[S]+\gamma(E[S])^2[/math]

Bahnemann does give a formula for the skewness of S but it's rather involved; if needed on the exam, the CAS would probably give you the skewness formula.

Note that the expected value of S does not involve the contagion parameter but the variance does.

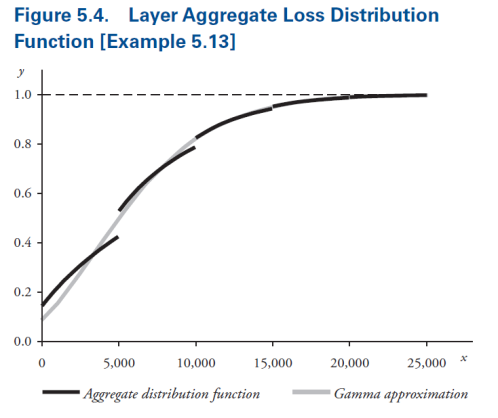

A key takeaway for aggregate losses in an excess layer is although the claim size is limited to a layer, as you get more claims, the aggregate distribution goes above the layer size. There are discontinuities in the distribution of aggregate losses, S. These discontinuities are larger at small multiples of the layer limit and become smaller at larger multiplies of the layer limit because there is more chance of a lot of claims within the layer summing to a larger total than a smaller total. (See Bahnemann Figure 5.4 below.)

Despite there being significant jump discontinuities in the lower end of the distribution for S, the approach can still give good results in the (long) tail of the distribution which is where we're normally most concerned.

Full BattleQuiz You must be logged in or this will not work.